“Most major construction equipment OEMs have introduced telematics offerings for their customers either independently or in collaboration with telematics partners”

Berg Insight, an IoT market research provider, has in a new market research project found that the global installed base of active construction equipment (CE) OEM telematics systems reached 6.2 million units in 2022. Growing at a compound annual growth rate (CAGR) of 12.0 percent, the active installed base is forecasted to reach 11.0 million units worldwide in 2027. This includes all CE telematics systems marketed by construction equipment OEMs, either developed in-house or provided by the CE manufacturers in partnership with third-party telematics players. The European market accounted for around 0.9 million active construction equipment OEM telematics systems at the end of 2022. The North American market is estimated to be somewhat larger than the European. The Rest of World moreover represents more than half of the global installed base of CE telematics systems provided by construction equipment OEMs.

“Most major construction equipment OEMs have introduced telematics offerings for their customers either independently or in collaboration with telematics partners”, said Rickard Andersson, Principal Analyst, Berg Insight. OEM telematics systems are today commonly factory-installed as standard at least for heavier machines and increasingly also for compact equipment. “Berg Insight ranks Caterpillar as the clear leader in terms of the number of construction equipment OEM telematics systems deployed worldwide”, continued Mr. Andersson. He adds that Caterpillar – which is also by far the leading construction equipment manufacturer by market share – has well over 1 million connected assets in the construction equipment segment specifically.

Based in the US, Caterpillar’s largest markets for its telematics offerings are North America and Europe. The runners-up are SANY and Komatsu based in China and Japan respectively, both major players on the respective domestic markets. Komatsu also has relatively large shares of its telematics units in China, North America and Europe. “Other major players with several hundred thousand active CE telematics units include Sweden-based Volvo Construction Equipment, XCMG in China, JCB headquartered in the UK and Japan-based Hitachi Construction Machinery”, said Mr. Andersson. Deere & Company, HD Hyundai and Doosan Bobcat are also estimated to have reached the milestone of 100,000 units. “Additional players having installed bases of construction equipment telematics units in the tens of thousands include Liebherr, Terex, JLG Industries, CNH Industrial and Tadano”, concluded Mr. Andersson.

Related Articles

Cost savings and reduced environmental impact with IoT and Wireless Sensor Technology

One of the most promising features of sustainable IoT solutions is the use of wireless and battery-free sensors The rapid evolution of the Internet of Things (IoT) is transforming the way we live and work. It offers businesses opportunities to become more efficient,...

Ellisys and Novel Bits LLC Enter Partnership for New Bluetooth Low Energy Training Program

Integration of Industry-Leading Protocol Analysis Tools to Add Real-World Component to Curriculum Ellisys, a worldwide provider of protocol test, analysis, and qualification solutions for Bluetooth®, Universal Serial Bus (USB), and other wired and wireless...

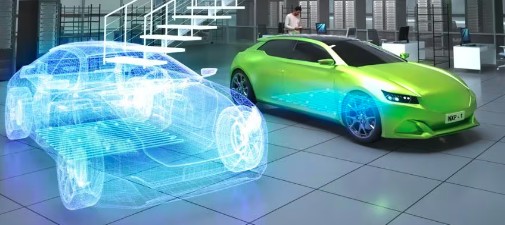

Are Digital Twins Transforming Automotive? 3 Things You Need to Know

With new trends such as electrification and autonomous driving, today’s vehicle can be described as a system of sub-systems Somewhere in Los Angeles in the United States, the Department of Transportation is partnering on a solution to create a data-driven digital twin...

Stay Up to Date With The Latest News & Updates

Our Sponsors

Incisor.TV partners with leading organisations in the technology sector.

Follow Us

And stay up to date with our news! We are active across the key social media platforms – please do follow us!

0 Comments