Market is driven by the growing need to connect assets and work forces in remote and temporary locations

Berg Insight, an IoT market research provider, has released new findings about the market for cellular IoT gateways and routers. More than 4.5 million cellular IoT gateways were shipped globally during 2021, at a total market value of approximately US$ 1.15 billion. Annual sales grew at a rate of 14 percent as demand recovered following the COVID-19 pandemic. The industry experienced at the same time constrained supply of key components like cellular modules and CPUs, resulting in extended delivery times. Sales growth has continued into 2022 but will likely slowdown in 2023 as economic conditions tighten across the main regions. Until 2026, annual revenues from the sales of cellular IoT gateways is forecasted to grow at a compound annual growth rate (CAGR) of 14 percent to reach US$ 2.18 billion at the end of the forecast period.

Cellular IoT gateways include general-purpose routers, gateways and modems that provide primary or failover cellular connectivity to devices in a local network. The product category has evolved over the past decades from simple networking devices to aggregation points for devices, implementing advanced functionality for security and edge computing. The market is driven by the growing need to connect assets and work forces in remote and temporary locations as enterprises digitalise their operations.

According to Berg, Cradlepoint, part of Ericsson since late 2020, is the clear leader in the space and differentiates itself by selling its routers combined with software and services exclusively through a subscription model. Teltonika Networks is the runner up and achieved the highest growth rate in the industry of close to 100 percent. Other vendors that hold significant market shares are Cisco, Sierra Wireless and Digi International. These five vendors generated US$ 625 million in combined annual revenues from the sales of cellular IoT gateways and routers and hold a market share of 54 percent. Other important vendors include MultiTech, Lantronix, Systech and Casa Systems in the US; InHand Networks, Peplink, Hongdian, Robustel and Advantech in Asia-Pacific; and HMS Networks, NetModule, Matrix Electrónica, Westermo and RAD in the EMEA region. The European and Asia Pacific markets are fragmented with a large number of small and medium sized players that generate annual revenues in the range of US$ 5–25 million.

Related Articles

Anritsu, Sony Semiconductor validate industry first Non-Terrestrial Network (NTN) NB-IoT testcase

First NTN NB-IoT Protocol Conformance Tests for have been validated on the 5G NR Mobile Test Device Platform Anritsu Corporation has announced that the first NTN NB-IoT Protocol Conformance Tests for has been validated on the 5G NR Mobile Device Test Platform ME7834NR...

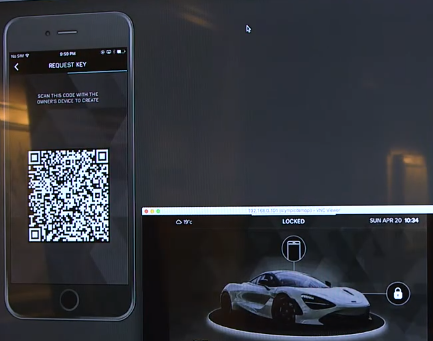

Ellisys Introduces Support for CCC Digital Key Technology

Protocol Updates Aid in Test, Validation, and Debug for Automotive and Consumer Electronics Developers and Test Labs Ellisys, a leading worldwide provider of Bluetooth®, Universal Serial Bus (USB), Ultra-Wideband, and Wi-Fi® protocol test and analysis solutions has...

Rohde & Schwarz 170 GHz power sensors ease use and traceability in the D-band

Rohde & Schwarz is launching the new R&S NRP170TWG(N) thermal power sensor for precise power level measurements in the D-band. The new R&S NRP170TWG(N) sensors from Rohde & Schwarz are used in general R&D for 6G mobile communications, novel sub-THz...

Stay Up to Date With The Latest News & Updates

Our Sponsors

Incisor.TV partners with leading organisations in the technology sector.

Follow Us

And stay up to date with our news! We are active across the key social media platforms – please do follow us!

0 Comments